E-Books:Risk Management.10.Principles

[vc_row][vc_column width=”1/2″][vc_column_text]Aim of the book

The last five years of the twentieth century witnessed significant changes in the way firms operate and in the fundamental structure of business units as globalization became more prominent. British industry has changed from primarily manufacturing based to predominantly service provision and, after the mergers and takeovers of the 1970s, came the trend for down-sizing to much smaller business units in the 1980s and 1990s. Total number of businesses has grown to around four million, the vast majority being sole traders or partners without employees, accompanied by the rapid growth in the use of telecommunications, the internet, part-time and temporary employment contracts and the use of home-working.Membership of the European Union has brought with it a stream of legislation and, more recently, a desire to bring all member states into closer alignment on employment and worker protection, social issues, taxation and other fiscal measures. This has been closely followed by many directives which seem to be blurring the edges between different disciplines[/vc_column_text][/vc_column][vc_column width=”1/2″ css=”.vc_custom_1543134153059{border: 4px outset #d6d6d6 !important;border-radius: 4px !important;}”][vc_single_image image=”7958″ img_size=”full” alignment=”center” css=”.vc_custom_1554967775433{margin-top: 2px !important;margin-right: 2px !important;margin-bottom: 2px !important;margin-left: 2px !important;}”][vc_text_separator title=”” i_icon_fontawesome=”fa fa-book” i_size=”lg” color=”blue” style=”shadow” border_width=”3″ add_icon=”true”][vc_btn title=”Click Here for more E-Books” style=”3d” color=”danger” align=”center” link=”url:http%3A%2F%2Fhsseworld.com%2Fdownloads%2F||target:%20_blank|” button_block=”true”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]when transposed into national legislation. Despite greater emphasis on recognizing the needs of small firms, there are considerable pressures, both internal and external, that require firms to be able to demonstrate to others that they are managing the business

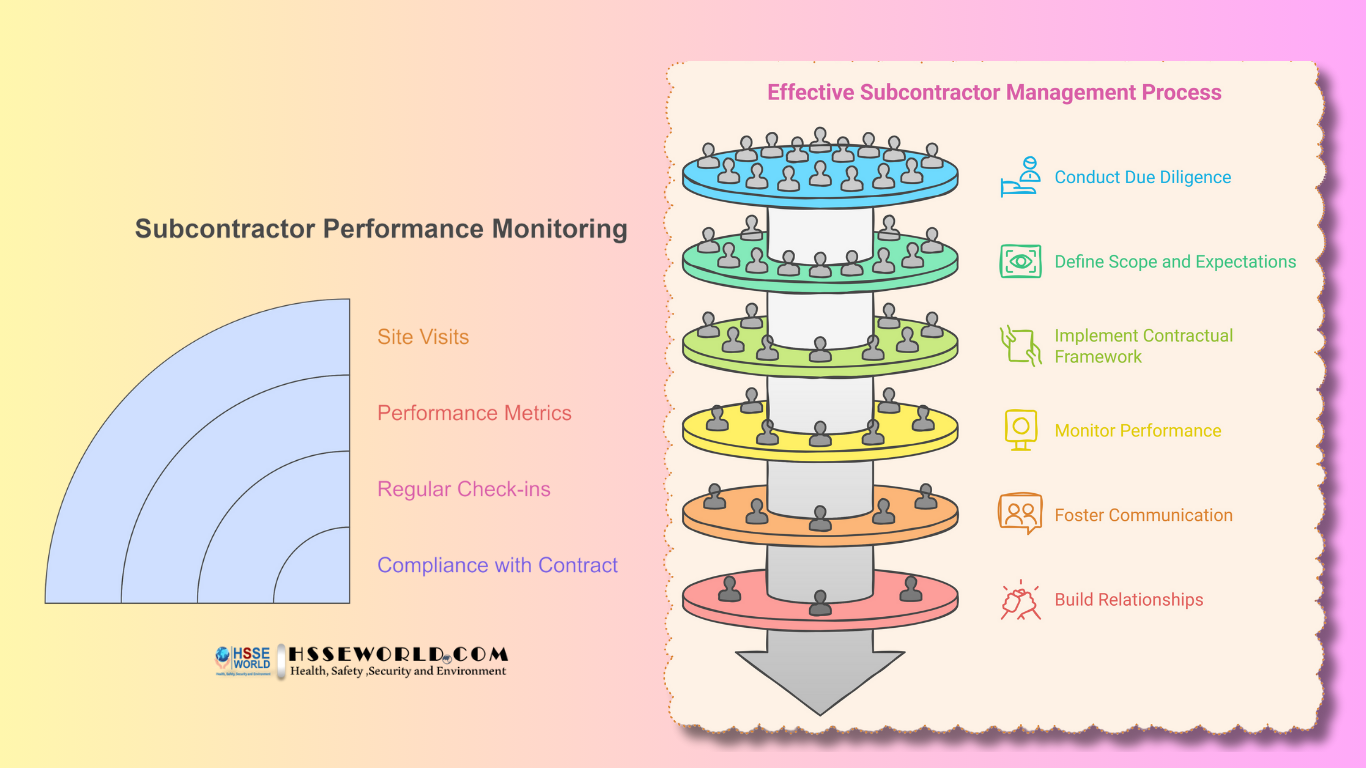

satisfactorily. While Figure 1.1 identifies some of these pressures, when considered alongside the changing and uncertain face of current competitive climate, we can see why risk management is often sidelined in smaller organizations.The ten elements of operation that represent the main risk areas to the success of a business are considered to be:

1 -Premises – where the firm is located, type of premises available for use, amenities, distribution routes, access for customers

2- Product – industry sector, features of product or service offered, life cycle and fashion trends, materials used in production, green issues, quality

3 Purchasing – access to supplies, storage and warehouse facilities, stock control, payment terms, cost

4 People – the workers in the organization, skills, training needs, motivation and commitment, incentive packages available, employment contracts

5 Procedures – production procedures, record keeping and reporting systems, monitoring and review, use of standards, emergency procedures

6 Protection – personal protection of workers and others, property and vehicle security, insurance cover, information systems, data security

7 Processes – production processes, waste and scrap disposal, skills, technology and new materials

8 Performance – targets set, monitoring, measurement tools, consistency, validity of data

9 Planning – access to relevant data, management skills, external factors and levels of control, short- and long-term planning, investment options

10 Policy – range of policies that support the strategic plans of the firm.[/vc_column_text][vc_single_image image=”7963″ img_size=”full” alignment=”center” css=”.vc_custom_1554969573898{margin-top: 2px !important;margin-right: 2px !important;margin-bottom: 2px !important;margin-left: 2px !important;}”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

Table of Contents

Part 1

1 Introduction …………………………………….3

1.1 Aim of the book …………………………….3

1.2 Business structures…………….. …………6

Sole trader/self-employed individual……. 7

Partnership ………………………………………..7

Small private limited companies…………..7

Medium-size limited companies ………….8

plcs and large organizations ………………..8

1.3 10 Ps of risk management ……………..9

Part 2

2 Identifying risk factors …………………..13

2.1 Risk assessment………………………….13

2.2 Identifying hazards……………………..14

2.3 Risk factors………………………………. 18

Premises …………………………………………18

Product or service …………………………….22

Purchasing ………………………………………26

People……………………………………………. 28

Procedures ……………………………………….31

Protection ………………………………………..35

Process ……………………………………………38

Performance……………………………………. 41

Planning ………………………………………….44

Policy ……………………………………………..47

3 Evaluating the hazards……………….. 50

3.1 What results are likely from exposure to these factors?.. 50

3.2 Who is likely to be affected?………. 56

4 Evaluating the risks …………………….57

4.1 Rating the extent of potential harm .57

4.2 Evaluating the likelihood that harm will occur.. 60

5 Controlling the risks…………………….. 62

5.1 Control measures ……………………….62

5.2 Systems of control ……………………..64

5.3 Deciding priorities for action ……….67

6 Case studies…………………………………72

6.1 Case study 1: health services ……….72

6.2 Case study 2: call centres……………. 76

6.3 Case study 3: food production and processing 79

6.4 Case study 4: engineering and manufacture 82

6.5 Strategic considerations for case study firms 86

Part 3…………………..…………………………………….. 89

7 Management strategies …………………………….91

7.1 Strategies for managing the risks ……………….91

Planning ………………………………………………………91

Range of strategic approaches for dealing with risks 95

7.2 Stakeholders and spreading the risks………… 99

7.3 Policies …………………………………………………101

Premises …………………………………………………….102

Product or service………………………………………. 103

Purchasing …………………………………………………103

People ……………………………………………………….104

Procedures …………………………………………………104

Protection………………………………………………….. 105

Process ………………………………………………………105

Performance ……………………………………………….106

Planning ……………………………………………………..106

8 Conclusions ………………………………………………108

8.1 Identifying the risk factors ………………………..108

8.2 Evaluating the risks …………………………………..110

8.3 Controlling the risks ………………………………….111

8.4 Managing the risks ……………………………………112

9 Useful references ……………………………………….. 115

Index ……………………………………………………………121

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_btn title=”Download The Book” style=”3d” color=”mulled-wine” i_icon_fontawesome=”fa fa-cloud-download” link=”url:http%3A%2F%2Fhsseworld.com%2Fwp-content%2Fuploads%2F2019%2F04%2FRisk-Management.10.Principles.pdf||target:%20_blank|” add_icon=”true”][/vc_column][/vc_row]